The ACIDcoil: A Hedge Fund Trade Memo

30 months of sideways. Then a clean break. Why Intuit’s breakout matters now.

A Hedge Fund Masterclass?

Ever taunted a shark tank full of geniuses with raw meat?

I did. Daily. I ran Eclectica Asset Management, steering hundreds of millions through storms unseen…

Let me tell you a secret. One that cost me years. One they don’t write in the textbooks. One you only learn when you’ve sat in my chair. One that requires at least ten years to harvest.

I ran Eclectica Asset Management. I managed hundreds of millions of dollars for some of the smartest, most demanding people on this planet. Sovereign wealth, billionaires, the kind of clients who expect you to see what others miss. Failure wasn’t theoretical. It was existential. You either found edges or you disappeared.

Think of life inside my hedge fund like a private shark tank, but the sharks are my own analysts. I’m not selling to clients. I’m not raising capital. That part was always distant, abstract, someone else’s job. My world was here, in the quiet, with my charts, my music, my madness.

When I saw something, when the pattern revealed itself, when the coil tightened just right, the first thing I wanted was an audience. I wanted to show it off. I craved that moment of recognition. The thrill wasn’t just in finding the idea. It was in testing it against the sharpest minds around me.

So I’d summon my team. My intelligence unit. The people paid not to agree but to interrogate me. I’d throw my wildest, most elegant, most absurd thesis at them like raw meat. Sometimes half-baked. Sometimes reckless. Always urgent. My job was to provoke. Theirs was to pull it apart, to question the foundations, to search for fractures in my logic before the market did.

It wasn’t thankless. But it was grueling. Their task was to extract order from my chaos, to filter my instinct through discipline, to grind my flashes of conviction against their slower, steadier analysis. And if an idea could survive that arena, then maybe, just maybe, it was strong enough to face the market itself.

What you’re reading here is an attempt to recreate that world. A glimpse into how conviction is really built. Not from certainty, but from conflict. Not from stories, but from pressure and constant child-like curiosity.

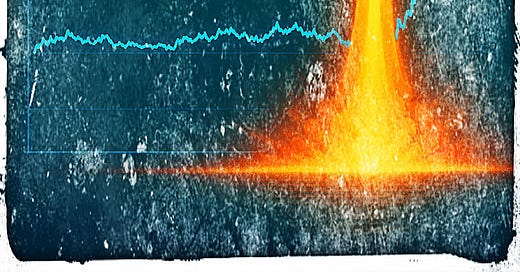

And in that furnace, over thousands of trades, thousands of charts, thousands of wrong turns, you start to notice something. A shape. A behavior. The market isn’t random. It breathes. It builds tension like a coiled spring. Quiet at first. Deceptive. The longer it compresses, the more brutal the release when it snaps.

That’s The Coil.