Confessions - Is there something better than great sex?

Wild bets, hot streaks, and a little market seduction.

By Way of Explanation

This one’s from the vault, published years ago, but I’ve sharpened the edges.

I’ve taken the original and reworked it with fresh teeth, rewiring it to read like a lost chapter from The Big Short or The Wolf of Wall Street. It’s raw, cinematic, and puts you right in the cockpit, the end of 2002, post-dot-com wreckage, as I step onto the stage as a first-time hedge fund manager with nothing but conviction and a gut full of crazy volatility.

If you’re new here, this gives you a proper taste, how I write, how I think, how I swing. It’s the origin story, and yeah, it’s got a little something for everyone.

Strap in. The ride starts here. A podcast version will follow soon.

Hugh

==========================

No one asked for a sequel. But I’m giving you one.

This is Confessions, Part II. October 2002. My second investment letter. My second shot at making sense of the madness.

If you’re new, welcome. If you’re one of the 3,000 who downloaded the first podcast back in 2020, thank you. You helped push me into the global top ten for finance podcasts. Now that’s hindsight.

Today, I want to take you back to the edge. The moment when the market was up 9 percent, and I was flatlining. The dollar was still flying, and I was building a case to take it down. There was no macro consensus, no safety net, and certainly no parade.

What follows is a memory, a reckoning, and a few bruises. Commodities, conviction, humiliation, and something close to revelation.

Let me show you what I was thinking then, before it all started to turn.

You want pressure? The kind that twists your gut and flickers behind your eyes? Month two of my first quarter running a hedge fund. The market’s up nine percent. Me? Flat for the month, but down 4.9 percent since launch. Holy shit. A grim, motionless purgatory. Did I name it Eclectica? Or E-shit-ica.

I placed my first real bet: short the dollar. The Dixie stood tall at 110. Five years later, it would crawl to 70. They laughed then. Now they squint at the same fractures, muttering predictions like they always see it coming. A Mar-a-Lago accord, the suits think the dollar could trade this path again. The mood shifting. Back then, the floor in my office hummed beneath the threadbare carpet. It was the end of 2002 and my investment letter had been dispatched. A currency market on the edge, the prospect of a hard fall.

Eclectica was never just a fund. It was metaphor, manifesto, and madness in motion. A wager on a world that drifts off-script, where the improbable isn’t rare, just poorly timed. It was built for the kind of investor who doesn’t chase the storm, but waits for it, knowing it always circles back and finds you. The kind who knows chaos doesn’t knock. That it slips the latch. That investor was me.

But back to the trade. I was short the dollar. I was long commodity futures. The CRB composite, if you want the detail. Bullish is too soft. I was convinced this was gold’s bottom, the ignition point of a supercycle.

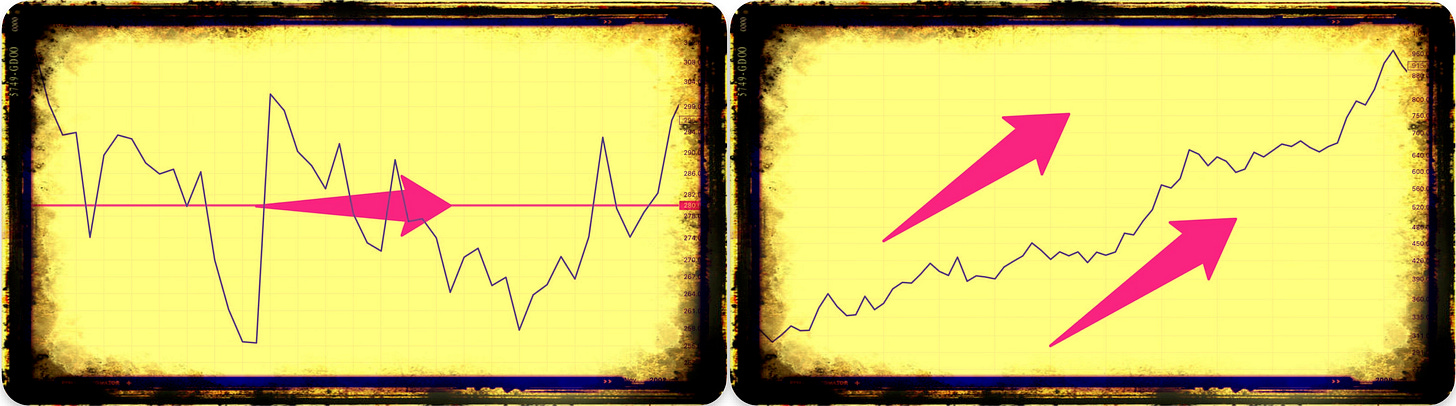

Look at the charts below. A decade of decline, commodities flatlining like a patient too long in the ward. That chart on the left, it’s all there. Something shifted. Prices stopped falling. Commodities stopped bleeding against equities. The tide turned. No one noticed the relative performance of that second chart. No one but me.

Stocks had collapsed post-1999. That was the trigger. That second chart, above. But for me, it was a deeper signal. A depth charge dropped into the still pond of my mind. The shockwave rippled out and I sent my team to the investment banks like bloodhounds. I needed to know, was this real? Was it structural? Could I scale it?

This wasn’t just about risk. It was about hunger. Could I stomach this trade at size? Could I make Eclectica roar like a racer pushing blind into a hairpin with no brakes. How fast did I really dare go?

My top five positions? What can I say? Slightly better than last month. I disclosed modest risk. Nothing was yet a big deal. I was still a sleeping tiger. Four percent in commodity futures? Boy how that would grow. But back then I had no teeth, I was still posturing, imagining the play. A paper predator, pacing the cage, waiting for blood in the air. Because underneath that number was something feral. The signaling of intent. The twitch in the trader’s eye. The first drop of blood before the hunt. I could see it, I was ready.

But first, I had to go to Amsterdam.

Not for the tulips. Not for the tourists. But for a company no one talked about: Amsterdam Commodities. It dealt in nuts and spices like it was still the 1600s. No website. No research coverage. No story, at least not one it wanted to tell. Just a foggy building, brown walls, the scent of stale cigars, and the faint trace of something feral in the books.

It was listed. But barely. Quoted, but not really present. And now? It’s gone.

Along the way, success, or something that resembled it, modified their world. The business changed its name. The stock code was switched. The charts no longer track that time. It's like Amsterdam Commodities never existed except in the mad hearts of men like me who dared to believe in things with no pitch deck, no face, and no need to impress.

As the robot said at the end of Blade Runner,

"All those moments will be lost in time, like tears in rain."

Only this one isn’t lost. It’s right here. Lit again for your benefit. Make of it what you will.

Amsterdam Commodities. The stock that smelled like hash and heresy.

But there are just too many things darting around in my head right now. Three threads, to be precise. First: George Lee. I want to talk about George. Second: Amsterdam. Let’s just say inspiration comes in many forms. And third: the big question. The big bang. Is there anything better than great sex?

In that order.

George Lee. I hired George. My recruitment process back then was borderline deranged. George arrived late, off-cycle, out of sync with the nice, clean graduate intake rounds. He told me, with no apology, that he’d forgotten he was supposed to find a career after university. Some would call that lazy. I called it promising. He was this untouched slab of granite. Uncut. Unshaped. And untouched by convention. That kind of blank canvas doesn’t show up often.

I hired him on instinct. What I saw was an immense mind quietly crunching everything around it. George was an abstraction from the tyranny of formality. A puzzle no one had dared try to solve. He stayed with me nearly twenty years. The man was an intellectual rock. Solid. Unbothered. Exacting.

Next. Amsterdam. Let’s talk about what I really did there on that so-called research trip. I was meant to investigate Amsterdam Commodities, a shadowy little firm dealing in exotic softs, you know, African spices, nuts, obscure pulses everything bespoke, off market. What I did instead was disappear into the smoke and noise of the city’s cafes. Let’s be honest. There wasn’t much hard data on the company. No pitch deck. No broker coverage. Not even a bloody website.

They weren’t exactly trying to sell anything. They weren’t trying to talk. That was the charm. They had a building that looked like it was designed by a Chernobyl set director, brown walls, ghostly furniture, everything infused with the smell of cigars and the slow rot of disinterest.

Why were they even listed? No one knew. They didn’t need us. They didn’t want us. And somehow, that made me want them even more.

At that early stage in the commodity cycle, everything felt paranoid and schizophrenic. I could hear the signal coming. But Wall Street? Still selling the ghosts of the last bull run and buying the banking franchises set to expire worthless five short years later. No one was talking about the next secular bull run. No one except the voices in my goddammed head.

So I went off-grid where I found creatures like Amsterdam Commodities. Strange, stubborn, silent. It was the only equity expression I could find for what I knew was coming.

Flash forward. Early 2008. Peak of the commodity super-cycle. I’m long a Brazilian sugar company, Cosan. Big position. I fly down to São Paulo to walk the walk, pound the ground. To see what we’re holding.

Their CIO refused to see me. No apology. No excuse. Just silence through the smoked glass of their shiny new HQ in Sa Paulo, one of those buildings with too much glass and not enough soul. I’d flown across oceans, across time zones, to look the man in the eye. And he sent a receptionist.

I sat there, watching them glide around like they ran the world. Polished shoes, dead eyes, expensive suits. The rage crawled up my spine. The Glaswegian in me stirred. That side of me? He doesn’t knock twice.

I pulled out my BlackBerry like a blade. Dialed my broker in New York. Told him to dump the whole goddamned 3 percent holding live, minute after minute, I dumped their stupid stock, all the time staring menacingly through the glass at the bastards who wouldn’t open the door.

Every tick lower was a slap. I wanted them to feel it. To watch their share price crack while I sat ten feet away. They learned something that day: you don’t ghost me. You don’t freeze me out. You show respect or I show you the bloody exit.

Treat me like a tourist? Fine. But know I don’t leave quietly. The stock cratered that year. Luck? Maybe. But the point is this: respect and returns are often tangled. Amsterdam gave me silence and substance. Brazil gave me glass and expensive attitude. One I held and it was one of the best performing European stocks that decade. The other I sold and it later merged with Shell, now trades as Raízen.

But at the start of the bull market, I had a higher tolerance for madness. I was building a centipede of a portfolio—dozens of strange, twitching little limbs, all moving in semi-coordinated chaos. Small, eccentric businesses I could back away from if the mood shifted. I wasn’t looking for marriage. I was dating the market. Fast, non-committal, instinctive.

Amsterdam Commodities fit the mood perfectly. Back then, it hadn’t yet straightened its tie. It was cheap. Obscenely so. You could pick it up at a 13 to 14 percent earnings yield and clip a 10 percent dividend on the side. It just threw off cash. Didn’t need love. Didn’t need attention.

Just needed someone crazy enough to notice.

Now then, is there anything better than great sex? I remember asking that in a packed hotel room in Paris, years later. The French, of course, leaned in. You could hear a pin drop. Brows furrowed. Smoke curled. Philosophical gears turned. They got it.

Fast forward a few months. Same line. Different room. Breakers, Palm Beach. The air was thick with disbelief. You’d think I’d shouted fire in a cathedral. Stone faces. Nervous laughter. No one wanted to touch the question. Funny, isn’t it? Warren Buffett calls himself an oversexed guy in a harem, and that’s charming. But I say it, and I’m a liability.

What gives, America?

Spoiler Alert! I’m going to suggest that yes, there is something better: the notion of making 10x times your money from a stock.

Try staring down a market no one believes in, buying a stock no one's watching, sizing up while the suits roll their eyes, and then watching it rip tenfold. A ten-bagger. Not a one-night high, not a fleeting moan, but a screaming, decade-defining, soul-rearranging move.

That’s not pleasure. That’s violence. That’s God whispering, you were right and they were all idiots.

Sex is great. A ten-bagger is better. It lasts longer. Leaves a mark. You don’t forget it. And when it hits? You don’t roll over and light a cigarette.

You reload.

What made Amsterdam Commodities such a great stock? Obviously, commodity prices trended higher, much higher. And then came Olam, the controversial Singaporean trader that paraded high returns and clockwork consistency, earning the sector a fat re-rating. Only problem? In Olam’s case, it was fiction. A fabrication wrapped in spreadsheets.

The Duchies, to their credit, stayed clean. Steady. True to their oddball DNA. They didn’t need to dress it up, and they didn’t get dragged down in Singapore’s shame spiral, well not much, the stock has derated in the years since.

But today? Today it probably trades somewhere between 15 and 17 times earnings. And once you're priced like that, you’ve got to deliver. Predictably. Reassuringly. Like a Swiss watch or a corporate HR memo.

And Amsterdam Commodities, well, it’s many things. Beautiful things, even. Now it has a website. An investor deck. Polished communications. But what it doesn’t have is predictability. Not the kind that justifies that kind of multiple.

So yes, I’ve cooled on it.

Was it better than great sex?

I don’t know.

But I’m thankful for the memory.

Hope you’ve enjoyed and maybe you join the acid tribe.

Hugh

Yes. Love. You can have great sex. But this alone will not ensure a couples survival.